Total Tax Burden

Much confusion exists concerning the actual tax burden facing Silver State residents. In popular narrative, Nevada

is often referred to as a low-tax, business friendly state. However, the state tax burden, in isolation, is not what taxpayers find most relevant: It is the total tax burden – including the taxes assessed at federal, state and local levels.

It is this total tax burden that impacts human behavior – distorting investment and employment patterns and shifting consumer demand toward tax-exempt purchases. Differences in the tax burden across city, county, state and even national boundaries prompt both businesses and individuals to relocate with increasing frequency.

In fact, there has been a sizable population shift within the United States over the past decade as individuals have moved from high-tax states to low-tax states. Over this time, nearly one person per minute has left the 10 highest taxing states for states with lower tax burdens.1

While attention in Nevada is often drawn to a state-level tax burden that falls slightly below the national median, the local tax burden faced by Silver State residents is above the national median and partially offsets this minor advantage.

Key Facts

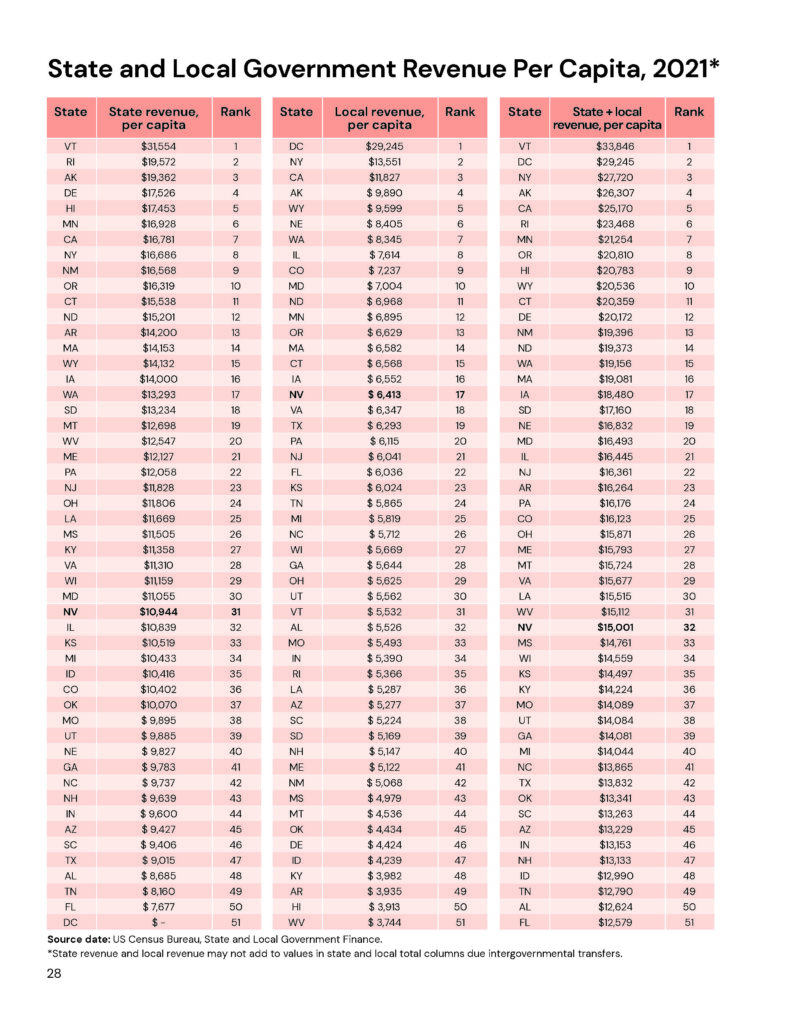

Nevadans face the 17th highest local government tax burden in the country. Tax collection data from the US Census Bureau show that Nevada’s local government revenues were $701 higher per capita than the national median in 2021.2

Nevadans face the 31st highest state tax burden in the country. Tax collection data from the US Census Bureau show the state of Nevada received $10,944 per capita in tax revenue in 2021. This amount is $862 below the national median, although still thousands of dollars higher than other states that have rapidly attracted residents and investment dollars like Florida, Tennessee or Texas.

Total per capita government revenues in Nevada are near the national median. When both state and local government revenues are considered together, Nevada is neither a particularly low-tax, nor a particularly high-tax state. Silver State governments collected $15,001 for every man, woman and child in the state in 2021 – good for 32nd highest in the nation.3

Nevada’s tax burden is at the median among contiguous states. Among regional neighbors, governments in California and Oregon receive more total tax dollars per capita than Nevada governments while those in Arizona, Idaho and Utah receive less.

A leading reason for high costs at the local government level is employee pay. Local government employee wages in Nevada in 2022 were 18.2% higher than the national average.4 If local government workers in Nevada earned merely the national median wage for local government workers, Silver State taxpayers would realize a two-year savings approaching $150 million.5

Recommendations

Control local government spending. Through constitutional provision or statute, limit the growth in local government spending to the rate of population growth plus inflation. Lawmakers should also reform or repeal NRS 288, Nevada’s collective bargaining statute, to eliminate upward pressure on local government spending from insider special-interest groups.

1 Arthur Laffer et al., Rich States, Poor States (15th Edition), American Legislative Exchange Council, 2022.

2 US Department of Commerce, US Census Bureau, State and Local Government Finance.

3 ibid.

4 See “Employee Earnings.”

5 Authors calculations based on data reported in U.S. Census Bureau, “Annual Survey of Public Employment & Payroll,” 2021 release.