Prevailing Wage

Since 1937, Nevada law has required that workers building state-funded public works projects receive a special kind of minimum wage, called “prevailing wage.”

Prevailing wage laws might sound like they are intended to ensure that workers receive wages reflective of the local labor market, but these laws are administered in a way that ensures construction unions are able to control these state-mandated wage rates.

This bias in favor of trade unions leads to wage rates far above those found on the local labor market. This inflates the labor-cost component of public works projects – straining taxpayer resources and ultimately limiting the number of projects that can be completed.

Key Points

The survey methodology is flawed. State-mandated prevailing wage rates are determined through a survey administered by the Nevada Labor Commissioner. However, the survey is structured to induce “sampling error” – meaning that the representation of unions among the responses is far higher than among the actual population. For numerous reasons, nonunion contractors would incur unrealistic accounting costs to complete the surveys.1

Even after the survey methodology has systematically excluded most nonunion contractors, the survey results are dismissed if at least 50% of its reported billable hours for a given job classification were subject to a collective bargaining agreement. In that case, Nevada Administrative Code 338 stipulates that the “prevailing wage” must equal the union wage.

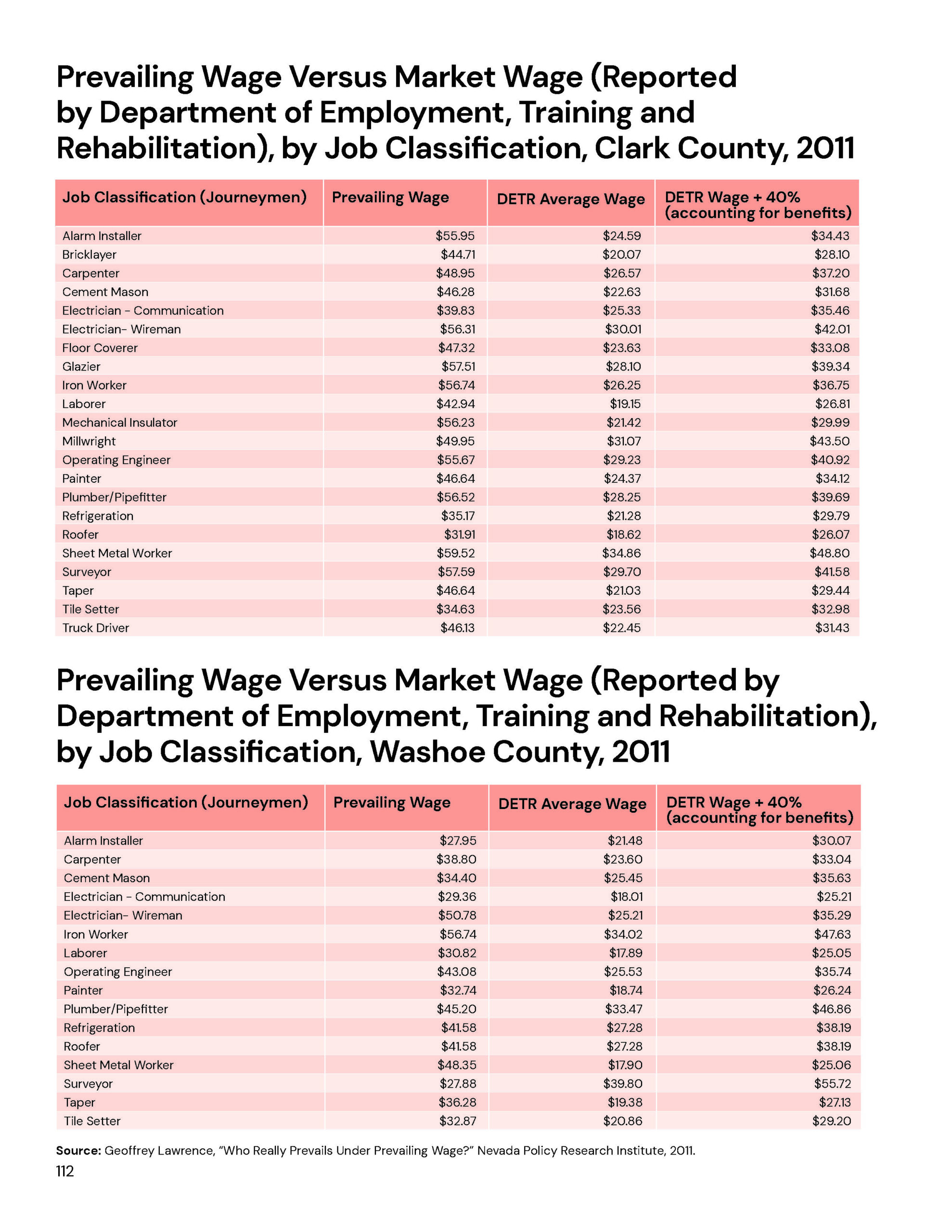

State-mandated prevailing wages are 45% higher than market wages, on average. The flawed survey methodology allows unions to dictate wage rates paid on public works projects in Nevada. As a result, workers on these projects typically receive a “wage premium.”

The approximate magnitude of the wage premium can be determined by comparing prevailing wage rates with wage rates paid in the local marketplace, as reported by the Nevada Department of Employment, Training and Rehabilitation. These figures show that, on average, workers receive a 44.2% wage premium in Northern Nevada and a 45.8% wage premium in Southern Nevada.

Wage premiums cost taxpayers an extra $1 billion in just 2009 and 2010. When the wage premium ratios are applied to the total cost of public works projects undertaken in 2009 and 2010, it becomes clear that nearly $1 billion was expended on wage premiums in 2009 and 2010 alone.2

Prevailing wage laws are racially discriminatory. Prevailing wage laws in the states are modeled after the federal Davis-Bacon Act of 1931 which effectively required union wages on federally funded projects. The explicit intent of the Davis-Bacon Act was to prevent contractors who employed black labor from winning federal contracts. At the time, trade unions systematically excluded blacks from membership. The Davis-Bacon Act aimed to legally undermine the ability of black workers to compete and ensure that federal contracts went to unionized, white labor.

Today, black workers remain statistically less likely to belong to a trade union. Thus, repeal of prevailing wage laws is “associated with … a significant narrowing of the black/nonblack wage differential for construction workers.”3

Recommendations

Repeal Nevada’s prevailing wage laws. In recognition of the racial discrimination, job loss and other economic distortions that result from prevailing wage laws, 10 states have repealed these laws outright since 1978.4

The Nevada legislature temporarily exempted school construction from prevailing wage requirements in 2015.5 However, those requirements were reinstated later in the same session, albeit at wage levels equal to 90% percent of the standard prevailing wage.6 Even this modest reform was reversed during the 2017 session following a change in leadership.7

1 Geoffrey Lawrence, “Who Really Prevails Under Prevailing Wage?” Nevada Policy Research Institute, 2011.

2 Ibid.

3 Daniel P. Kessler and Lawrence Katz, “Prevailing Wage Laws and Construction Labor Markets,” National Bureau of Economic Research Working Paper No. 7454.

4 Op cit., note 1.

5 Nevada Legislature, 78th Session, Senate Bill 119.

6 Nevada Legislature, 78th Session, Assembly Bill 172.

7 Nevada Legislature, 79th Session, Assembly Bill 154