Double Dipping

Originally passed in 1947, The Nevada Public Employees’ Retirement Act specifically prohibited public-sector retirees from receiving pension benefits if they accept new “employment or an independent contract with a public employer” that pays one-half or more of the average salary for state and local workers, excluding public safety officers. This limitation was intended to prevent abuse of the pension system by workers who had no intention of retiring.

In 2001, however, lawmakers created an end-run – NRS 286.523 – around this prohibition, to allow public-sector workers to receive pension payments without ever leaving their salaried positions. To do so, workers must only convince their superiors to classify their position as one that suffers from a “critical labor shortage” (CLS). Once the position has been thus classified, a worker can immediately declare retirement and start collecting pension benefits while remaining in their position and receiving a full salary.

Key Points

Abuse of the CLS exemption has been rampant. Lawmakers’ intent in crafting the CLS exemption was to alleviate a perceived shortage of teachers during the 2001-2003 biennium by allowing school districts to re-employ retired teachers.

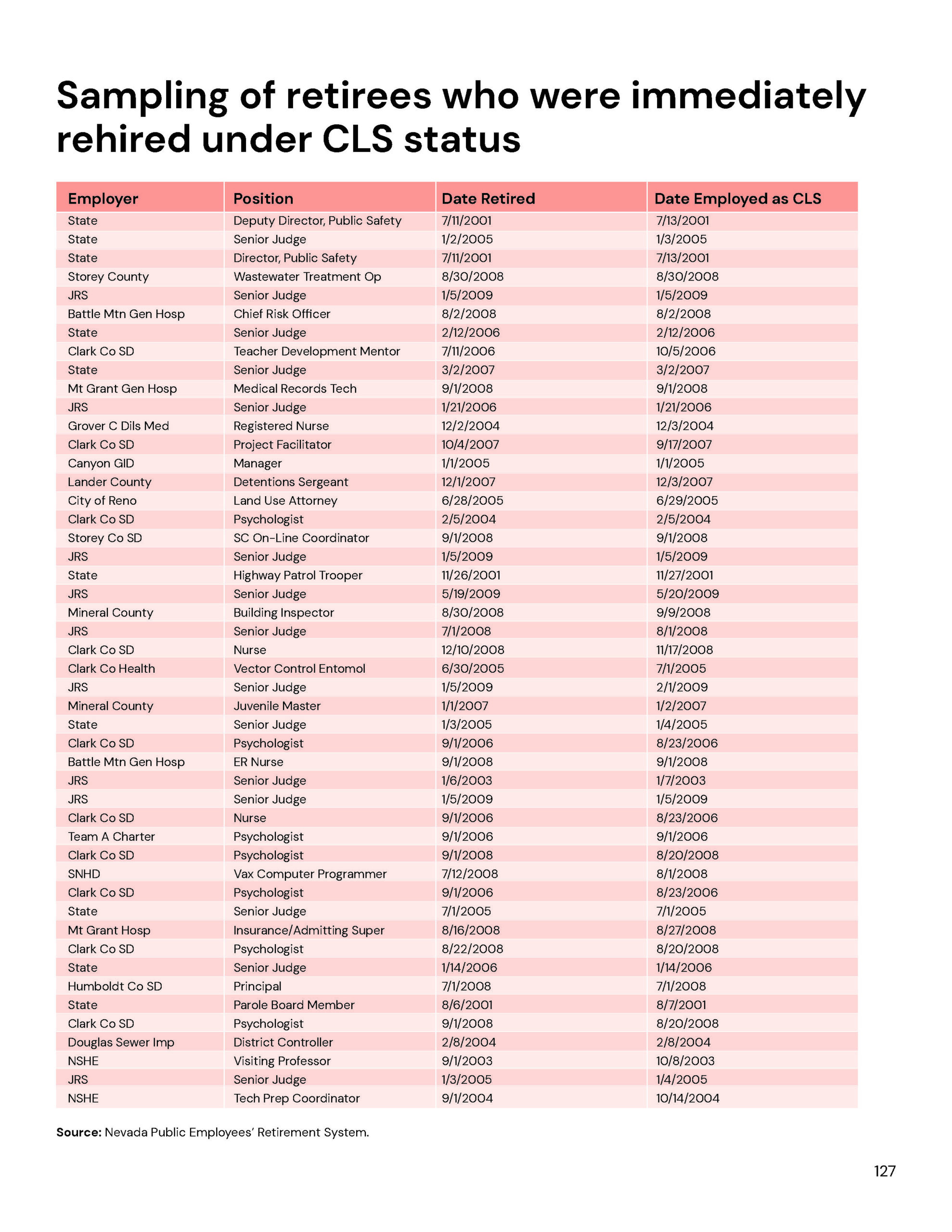

However, the first positions to be classified as CLS positions were those held by high-ranking political appointees within the Guinn Administration – including one cabinet-level appointee. On Jan. 10, 2001 – immediately after the CLS law became effective – the Board of Examiners classified the director of public safety and deputy director of public safety positions as CLS. The next day, incumbents Richard Kirkland and David Kieckbusch officially retired and two days later they each resumed their positions with CLS status. Records show Kirkland began receiving $70,000 in annual pension benefits in addition to his cabinet-level salary of $103,301 as a result of the change.1

As CLS induces more workers to declare retirement, PERS realizes a financial loss. An actuarial review commissioned by PERS shows Kirkland and Kieckbusch were not alone in abusing the CLS exemption. Nearly 44% of the workers that have filled CLS positions did so without ever leaving the workforce. PERS actuaries concluded that the retirees who “immediately returned to their positions would not have otherwise retired if there was no opportunity to be rehired under critical labor shortage exemption.”2

As a result, PERS made avoidable pension payments of $54 million to these workers between 2001 and 2008. PERS administrators have testified that these CLS-related payments exacerbate the PERS unfunded liability and resulted in higher contribution rates from state and local governments to keep the fund solvent. PERS actuaries have determined that the CLS exemption is directly responsible for raising contribution rates by 0.33% of payroll.3

Lawmakers acted against the advice of the Retirement Board. The CLS exemption would have expired prior to FY 2010 if lawmakers had not reauthorized it. Because of the exemption’s detrimental effects on PERS finances, the Retirement Board had recommended its discontinuation.4 Despite this recommendation and the labor force reductions required at that time due to recession – which should have undermined the very concept of a “labor shortage” – lawmakers during the 2009 session reauthorized the CLS exemption.

Recommendations

Immediately discontinue the CLS exemption. The Silver State suffers from an effective unemployment rate (u6) of 10.3%.5 Even if Nevada suffered from a labor shortage two decades ago, that certainly is no longer the case. Unfortunately the CLS exemption has, in practice, become little more than a mechanism for well-connected bureaucrats and even political appointees to loot the assets held by PERS. The CLS exemption inspires cronyism and corruption. It should be discontinued immediately.

1 Nevada Public Employees’ Retirement System, “Critical Labor Shortage Estimated Cost through Nov. 1, 2008,” Presented to Legislative Interim Retirement and Benefits Committee 15 Dec. 2008; see also, Martha Bellisle, “Nevada’s Pension Laws Allow Double-Dipping,” Reno Gazette-Journal, 30 May 2011.

2 Nevada Legislature, Minutes of the Legislative Interim Retirement and Benefits Committee, 15 Dec. 2008.

3 Ibid.

4 Ibid.

5 US Department of Labor, Bureau of Labor Statistics, “Alternative Measures of Labor Underutilization for States.”