Publicly Funded Stadiums

In 2016, then-Gov. Brian Sandoval called lawmakers into a special session to authorize the largest public subsidy for a professional sports stadium in world history. That legislation required Clark County to issue $750 million in general obligation bonds and directed the county to commit the proceeds of those bonds to development of a football stadium. The county deposited these funds into a newly created Las Vegas Stadium Authority that would technically own and manage the stadium and enter into a lease agreement with the Raiders. The authority would also sell personal seat licenses to customers and accept capital contributions from the Raiders and sponsors to develop a $1.9 billion total stadium. The $750 million in public debt would ultimately be backed by Clark County taxpayers, but the measure also included a new tax on hotel rooms intended to defray the cost of debt service.1 In 2020, then-Gov. Steve Sisolak ordered hotels to close, interrupting this revenue stream.

Six business days prior to the conclusion of the 2023 legislative session, Gov. Joe Lombardo introduced a proposal to publicly finance a professional baseball stadium to recruit the Oakland Athletics. The proposal would require Clark County to issue another $120 million in general obligation bonds and would divert the proceeds of all sales tax, live entertainment tax and payroll tax that would normally accrue within the stadium from the Athletics and third-party vendors to defray debt servicing on the bonds. It would also award $180 million in transferable tax credits to the Athletics and direct Clark County to abate property taxes and create other tax credits. All of this summed to a $380 million public subsidy. Lawmakers didn’t approve the proposal prior to the session’s conclusion, but they were recalled into a special session the following week and approved the bill after adding additional expense items.2

Key Points

Professional sports are private businesses. Professional sports leagues were first developed in the mid-19th century because a rising American middle class was gaining disposable income and sought entertainment. William Hulbert recognized this market potential and organized the National League of Professional Baseball Clubs. The various franchises would generate revenue through ticket sales and advertisements to pay their costs and earn a profit.

Although sporting events can create a sense of community, professional franchises still follow the same basic business model from the 19th century. Public subsidies toward capital expense simply wind up padding private earnings for these franchises.

Stadium subsidies fail to create economic growth. Subsidy supporters often allege that stadium spending produces “multiplier effects” that will lead to widespread prosperity. These analyses invariably ignore taxpayers’ loss of disposable income due to higher taxes and the inverse multiplier created by this loss. Even when taxes are concentrated on items paid by tourists, these higher prices lead to marginal declines in tourism demand.

According to Stanford economist Roger Noll, who specializes in this field: “NFL stadiums do not generate significant local economic growth, and the incremental tax revenue is not sufficient to cover any significant financial contribution by the city.”3

A 2022 meta-analysis of 130 studies examining the economic effects of stadium subsidies concludes: “Even with added non-pecuniary social benefits from quality-of-life externalities and civic pride, welfare improvements from hosting teams tend to fall well short of covering public outlays.”4

Recommendations

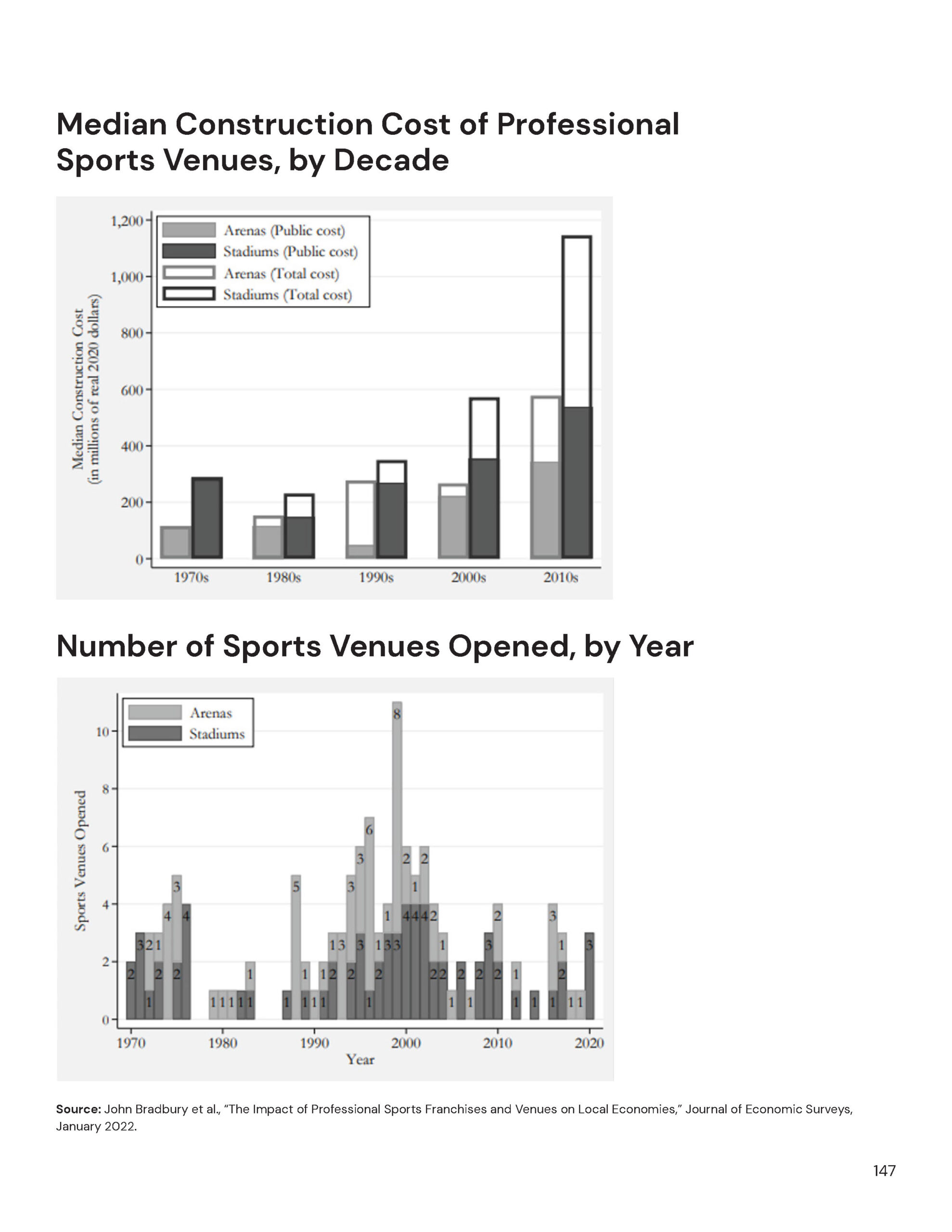

Do not allocate public dollars to stadium building. State and local governments in the U.S. spent $33 billion on stadium subsidies between 1970 and 2020. Economic data overwhelmingly shows this spending has resulted in a net loss to taxpayers.5

1 Nevada Legislature, 30th Special Session, Senate Bill 1.

2 Nevada Legislature, 35th Special Session, Senate Bill 1.

3 Clifton Parker, “Sports Stadiums do not Generate Significant Local Economic Growth, Stanford Expert Says,” Stanford News, July 30, 2015.

4 John Bradbury et al., “The Impact of Professional Sports Franchises and Venues on Local Economies,” Journal of Economic Surveys, January 2022.

5 Ibid.