State Lottery

Nevada lawmakers have repeatedly considered creating a state-run lottery to generate additional state revenue. In so doing, however, lawmakers have purposefully ignored the advice of their own consultants.

In 1988, Nevada lawmakers commissioned a tax study from the Urban Institute and Price Waterhouse.1 This study is still regarded as the most significant and comprehensive examination of Nevada’s fiscal structure.

The study contains an entire chapter that examines whether Nevada should adopt a state-run lottery and concludes that the state should not do so for several reasons.

Key Points

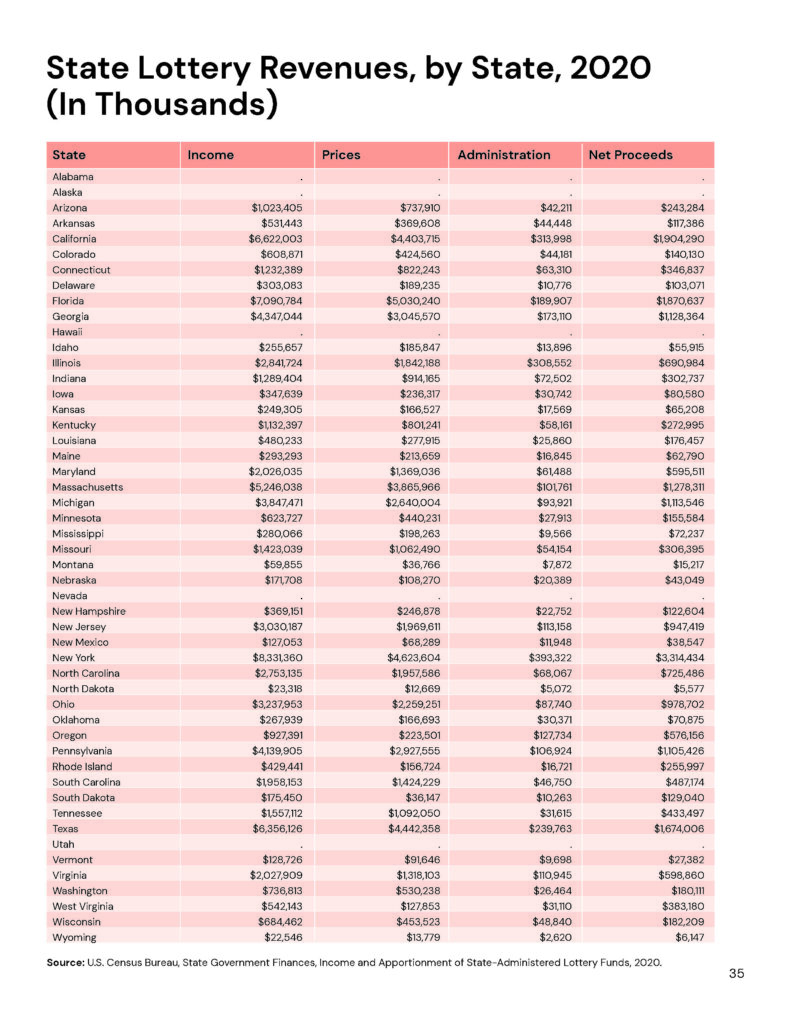

State-run lotteries do not generate significant revenues. Lottery revenues account for less than 3% of total tax revenues, on average, in states that administer these games.2

State-run lotteries are not stable revenue sources. Nationwide, state lottery revenues fluctuate dramatically from year to year – for many reasons. Data shows that lottery revenues have increased by as much as 250% percent year-over-year, and have decreased by as much as 50% percent year-over-year. This high degree of volatility renders budgetary planning based on these revenues extremely difficult.3

State-run lotteries are a highly regressive form of taxation. Studies indicate that individuals at the bottom of the income scale spend a far higher percentage of their income on state lottery purchases, making state lotteries a highly regressive implicit tax. In fact, as Price Waterhouse says, “The information indicates that as a tax, lotteries are among the most regressive.”4

In Nevada, a state-run lottery would compete directly with the private sector. Nevada is most unique among the states in the extent to which private-sector gaming is a legal enterprise. A state-run lottery would compete directly with private forms of lottery such as keno. Moreover, the state already draws revenue from these private-sector games through its array of gaming taxes.

Recommendations

Do not create a state-run lottery. As Price Waterhouse – the Nevada Legislature’s own tax consultant – has concluded, “A state-run lottery fails every test of a ‘good’ tax policy. In Nevada, gaming should be left to the private sector.” 5

1 Ed. Robert D. Ebel, A Fiscal Agenda for Nevada, The Urban Institute and Price Waterhouse, Prepared for the Nevada Legislature, University of Nevada Press, Reno, 1990.

2 Ibid, p. 418.

3 Ibid, p. 420.

4 Ibid, p. 422.

5 Ibid, p. 17.